Financial Aid FAQ

FinaNcial Aid Hours

Monday – Friday: 8am – 4:30pm

Financial Aid Contact Information

Phone: 510-748-2391

Email: coafinancialaid@peralta.edu

Financial Aid (24)

Yes. For each semester that you receive aid you will need to complete a certain number of units with a minimum GPA of at least 2.0. In addition, you need to maintain an overall completion rate of at least 67% and an overall GPA of at least 2.0. This is called maintaining “Satisfactory Academic Progress.”

Yes. Please make sure to visit your college Financial Aid Office 7 – 10 days after you have done so.

No. You will be eligible for most Federal Financial Aid if you attend school half-time. However, with the Pell and SEOG Grants, your awards will be larger if you attend full-time.

Yes. Payments for student loans begin once a student leaves school for six months (or falls below half-time enrollment for six months).

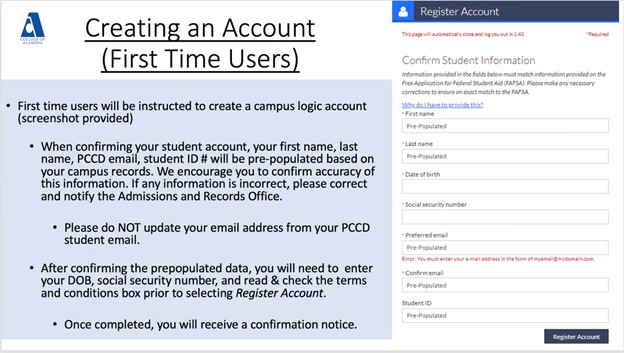

If you have not registered with the CampusLogic website for financial aid, you will need to do that first: alamedaperalta.verifymyfafsa.com

You must complete the FAFSA (Free Application for Federal Student Aid) . You can do it electronically at www.fafsa.gov. Once completed you will receive a Student Aid Report (SAR) via e-mail or in the mail. Please review your SAR and bring it to the Financial Aid Office in Building A-101 to check if there are any corrections to make.

Parents can e-sign the required forms, but they first need to create an account.

NOTE: Creating an account in the CampusLogic Website for Financial Aid cannot happen until until the student requests the signature and the parent is sent an email.

When a student requests a parent to e-sign a document, the parent will receive an email that tells them that there are documents to sign and provides them with a link to log in or register. When the parent clicks on the link to create an account, they will be directed to the Secure Parent Log-in screen. They will want to click the button that says- create account:

The parent is required to complete the following information:

- Preferred email

- Confirm email

- Choose username

- Create password

- Confirm password

The parent will then need to confirm their information. This will also need to match the information that was provided on the aid application

- Parent First name

- Parent Last Name

- Parent Date of Birth

- Parent Social Security Number

Once the parent confirms their information, they will be asked to confirm their student’s information. Again, this needs to match the information that was provided on the aid application.

- Student first name

- Student last name

- Student date of birth

- Student social security number

After the information is entered in, the parent will want to review the privacy policy before clicking on the Create Account.

If the account creation is successful, the parent will be routed to the log-in page. The parent will also receive an email asking them to confirm their email address. THIS STEP IS IMPORTANT- confirming the email address allows the parent to use the “forgot password” feature in the future, should it be forgotten. If the email is not confirmed, then the parent will need to call to have their password reset.

After logging in, the parent will be presented with the forms that need a signature. The parent should review the information the student put in the form.

Making updates to the form

If the information is not accurate, the parent can click on the “form not approved” button and the form will be sent back to the student to update.

Opting out of e-sign

The parent can also opt out of e-signing the form. If that is selected, both the student and the parent will need to provide signatures on the form.

E-signing the form

If the parent approves the form, they can sign the form using the same signature they created during the log-in process.

Provided that you maintain satisfactory academic progress, you can receive Federal Financial Aid until you exceed 150% of the published length of an eligible program. (In other words, students in 60 unit A.A./A.S. programs or planning to transfer to 4-year schools will need to complete their studies by the time they earn 90 units.) Students who exceed the maximum time-frame may petition for an extension of funding through an “appeal process.”

It may take at least 4-8 weeks.

It depends upon your family’s situation. The maximum Pell Grant would be $5,815 per year. The maximum Subsidized Stafford Loan for a first year dependent student is $3,500. Work-study allocations usually begin at $3,800 per year.

Call 1-800- 4-FED-AID / (800) 433-3243 (Note: If you provided an e-mail address, the SAR will be sent to you electronically.)

It might be difficult–especially in the first year. However, regardless of your income in the previous year, you will probably qualify for student loans.

Not necessarily. Applicants for Federal Financial Aid (below the age of 24) are considered to be dependents, unless they are married, a veteran, an orphan, a ward of the court, or have dependents (usually children).

No. You need to complete a separate COA Application for Admission.

Generally, grant recipients receive two checks a semester. One check comes at the beginning of the term and one check comes at the middle of the term. Loan recipients usually get two checks a year: one in Fall and one in Spring. College Work-Study students get one paycheck a month.

Yes & No. Students may submit a FAFSA (Free Application for Federal Student Aid) application as early as October the year before the academic year you are applying for. Students that apply by March 2 will receive priority consideration for several types of Federal Financial Aid. Students that don’t meet the priority deadline can still apply throughout the school year. (However, some Federal Financial Aid may no longer be available for those that apply late.) There is also a second deadline of Sept. 2 for Cal Grant consideration.

Students need to send their official transcripts (from ALL non-district schools that they have attended) to the COA Financial Aid Office. In addition, about a third of the applicants will be chosen for verification and will need to submit the required documents prior to their file being processed.

- When you have successfully logged into the CampusLogic website for financial aid, you will be taken to a task list- select anywhere on the task to expand and get additional information about what is needed.

- Some tasks you will be able to satisfy completely online, while others will require you to download, complete, and upload back to the task.

- To e-sign an online form, you will need to create a pin that you will use to sign all your online forms on the CampusLogic website for financial aid. You can also opt out of e-signing your documents- it is up to you!

- Dependent students may have forms that require a parent signature. After you (the student) have e-signed a document, you will have the option to request a parent signature. You will need to:

- Select the parent you would like to sign the document

- Enter the the parent’s email address

- Confirm their email

- Select the Send Request button

Upload any documents needed to complete your tasks. Once all documents are completed and all additional information uploaded, you can submit your verification for review.

The FSA ID is your official Federal Student Aid ID, which you will use to log in to your FAFSA (Free Application for Federal Student Aid).

CampusLogic is a secure document upload system that allows you to complete your outstanding Financial Aid tasks online.with secure document upload from any device, and e-sign capabilities? It is an easy, mobile, personalized process that makes everything about navigating financial aid easier.

Verification is proving that the income you reported on the FAFSA (Free Application for Federal Student Aid) is correct. Usually, verification is completed by submitting a photo copy of your and/or your parent’s federal tax return. In addition, you will be asked to submit a Verification Worksheet to confirm your Dependent or Independent status.

There are three types of Federal Financial Aid: grants, loans, and work-study. A grant is free money. Loans are borrowed from the government and MUST be repaid. Work-study is a job on campus.

You will be able to:

- Securely upload documents from any device.

- E-sign documents—both you and your parents.

- Manage your financial aid tasks online

- Receive automated reminders about outstanding tasks and next steps

Because many people are applying for financial aid. But here’s a rough breakdown of the steps and the approximate timeframe for each: For you to receive your SAR after you have submitted your application online (Free Application for Federal Student Aid): 2 to 4 weeks; For COA to process your file: 4 to 6 weeks.

Other Programs and Resources

College of Alameda is a diverse, supportive, and empowering learning community for seekers of knowledge. We believe through an exchange of experience, ideas, culture, and identity the lives of all CoA students are enriched. As such, all CoA programs are open access for all students to benefit from the richness of our diverse community. We encourage all students to participate in CoA’s cultural programs, events, and celebrations. We welcome you to join us and personifying our inclusive spirit!